Patience Pays: Avoiding False Breakouts in Forex

Ever found yourself in this situation? You spot what looks like a strong breakout, and quickly place your trade, only to watch the price reverse just a few candles later, leaving you frustrated and out of pocket.

If that sounds familiar, you’re not alone. False breakouts are one of the most frustrating aspects of Forex trading—they can wreck your confidence and chip away at your account if you don’t learn how to handle them.

In this article, I’ll share how I’ve learned to approach these moments differently. The key? Patience.

Developing the discipline to wait for proper confirmation before entering trades can not only save you from false breakouts but also lead to more consistent and profitable results.

I will explain how false breakouts happen, and what price action patterns can actually help you sit on your hands and keep you out of false breakouts.

I will also reveal a powerful tool that you should be using to mitigate the risk of false breakouts even further.

Avoiding false breakouts isn’t just about patience, though—it’s about using the right tools. Over the years, I’ve found ways to avoid the majority of these traps.

Combined with the discipline of waiting for the market to show its hand, this approach has become a game-changer in my trading strategy.

If you’re tired of being on the wrong side of breakouts, you don’t have to figure it out on your own.

If you haven’t yet got a profitable strategy to trade the financial markets. Checkout my Precision Pip Pro E-book.

Let’s dive into the practical steps that can help you turn false breakouts into winning opportunities.

Understanding False Breakouts in Forex

What Are False Breakouts?

A false breakout occurs when the price appears to break through a key support or resistance level, triggering what seems like a great trading opportunity. But instead of continuing in that direction, the price quickly reverses, leaving traders stuck in losing positions and in a state of hope. These traps are common in the Forex market and can be particularly challenging for newer traders who are still honing their skills.

I remember my earlier days trading when I’d jump into every breakout setup I’d seen, believing the price would keep going. Almost every time, I’d watch in disbelief as the market reversed, hitting my stop loss almost as quickly as I entered. It was a painful lesson that not all breakouts are what they seem.

What Causes False Breakouts?

False breakouts can happen for several reasons, and understanding these can help you avoid falling victim to them:

- Market Noise: This is caused when liquidity and volume are low on a certain instrument. Instantly changing the instrument to a low-volatility asset. This will ultimately cause the price to make price fluctuations without volume or any real power behind the move.

- News Events: Sudden or Unexpected announcements or economic data releases often lead to rapid price movements. These swings sometimes look like a whole new shift in the momentum of price but again, there are no big players there to sustain the move which makes these “knee-jerk” reactions nothing but a false breakout.

- Lack of Follow-Through: Even when a breakout seems valid, You watch the price as it seems to hold well. Just as you are about to pat yourself on the back price stabs it first as it falls back to the previous level before the breakout. This also happens if there isn’t enough momentum or volume to fuel the move.

The Consequences of False Breakouts

The ripple effects of falling for a false breakout can be dangerous. Not only do you take an immediate financial hit, but the emotional toll can be even more damaging. It’s frustrating, and demoralizing, and can lead to impulsive decisions like revenge trading or abandoning your strategy altogether.

I’ve been there—getting stopped out repeatedly, feeling like the market was out to get me. But over time, I learned that reacting emotionally to these moments only made things worse. Instead, I started focusing on managing these situations proactively.

False breakouts are inevitable in Forex trading, but they don’t have to derail you. By understanding their causes and learning to spot them, you can minimize their impact and keep your trading on track. Next, I will show you some price action signs that will let you know the market is indecisive or not yet ready for a breakout. This can help you execute your trading strategy with more precision and confidence.

Price Action Patterns To Stay Out of Trades

Barbed Wire

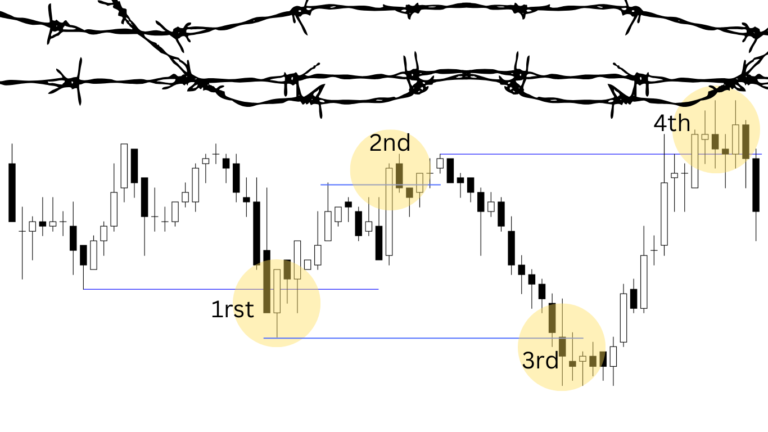

The first price action pattern to look out for is known as barbed wire. The image above is an example of how it appears on a chart. To the left, there is a range that contains the price.

This is followed by the 1st false breakout in price, only to quickly reverse back in the range on the following candle.

Next, the price forms a bear flag pattern which is contained between the 5 consecutive bear candles that instigated the 1st false breakout. Price then aggressively moves bullish in an attempt to break above the flag, creating the second false breakout.

At this point, you can see how the market has trapped buyers and sellers in a struggle to push the price. Knowing that neither buyers nor sellers are making money here should be enough reason to sit out of the market until there is a clear winner.

Never try to guess because even the market doesn’t know where the volume is. This is evident as soon after you see the market testing selling liquidity at breakout attempt 3.

In this case, it never found enough volume which then forced the price to sweep the buyer’s liquidity at the 4th breakout failure in this illustration.

This happens frequently in every market and is very easy to spot once you know what you’re looking for.

Large Candles

Another red flag price action pattern reveals itself in a single-candle. The image above illustrates how this looks in real-time.

This is the event of seemingly random volatility coming into the market to paint a candle that is significantly larger than the previous candles that break out above the highs or below the lows. In this case, the bar is bullish.

This can lure traders into bad trading decisions because at the time when you are watching. It looks like a big move is about to begin and you instinctively want to catch it as early as possible.

Then surprise-surprise, the market instantly reverses the other way, yet again trapping traders in its tracks.

Broadening Wedge

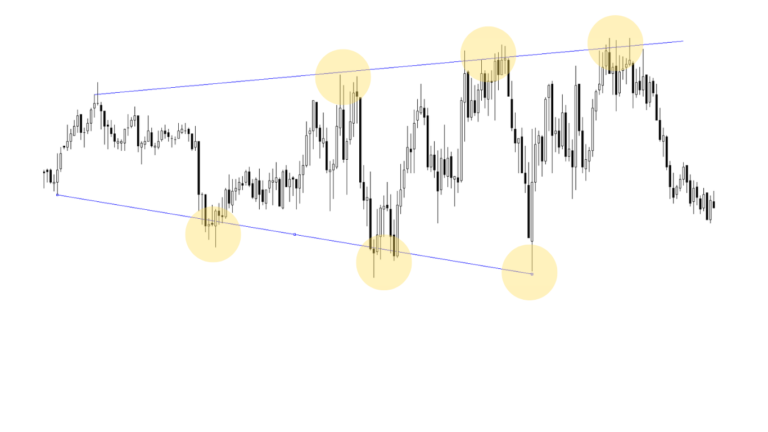

The final price action pattern that I’ve come across that protects my capital is the broadening wedge. Check out the image above.

This is another form of the barbed wire pattern but it tends to go on for a longer duration and gives a deeper definition that helps train your eye on how to spot false breakouts more effectively. It shows you how long a struggle between buyers and sellers can take.

The truth is, it doesn’t matter what timeframe you trade. In reality, is that all three of these patterns are the same. For example, if you trade the 5-minute timeframe and you see a large candlestick?

Within this candle on a micro timeframe such as 1 or even 30 seconds, you would be sure to find the barbed wire pattern that makes up the large bar on the 5-minute candle.

The Role of Patience in Avoiding False Breakouts

Patience as a Strategy

In trading, patience is a must. The Forex market is filled with temptations to act impulsively, especially when it seems like a breakout is happening.

Jumping in too early can often mean stepping right into a false breakout. Patience allows you to wait for the right conditions and avoid unnecessary losses.

Early in my trading journey, I thought the quicker I acted, the better my results would be. If the price edged near a key level, I was in the trade without hesitation.

This impatience cost me as many of those trades reversed almost immediately. After so many losing trades, I knew I had to improve and implement more safeguarding methods into my Forex trading strategy.

I’ll discuss these in more detail soon. With these methods in place, I learned that waiting—even if it felt like missing out—was a form of discipline that paid off.

Trusting the Market

Patience is about trusting the market to show its true intentions. It means waiting for confirmation that a breakout is genuine before committing to a trade.

This might involve watching the price hold above a key level for several candles, checking for increased volume, or waiting for a specific candlestick pattern.

It’s not easy to sit back when the market is moving, but one of the biggest lessons I’ve learned is that the market will always provide opportunities.

By forcing myself to wait for confirmation, I’ve avoided countless false breakouts and made better-informed decisions.

Backtesting for Insight

One of the most eye-opening moments in my trading came during backtesting.

Reviewing my trades revealed a pattern: many of my losses occurred because I entered breakouts prematurely. In contrast, the trades I waited on—those with clear confirmation—tended to perform much better.

For example, I found that by waiting for the price to move at least one pip beyond the breakout level before entering, I reduced false entries significantly.

Pairing this with buy and sell-stop orders made my approach even more robust. The data was clear: patience isn’t just about avoiding losses; it’s about setting yourself up for consistent gains.

By embracing patience, you transform from a reactive trader to a strategic one. It’s not about how quickly you can act—it’s about how smartly you can wait.

Let’s explore buy and sell-stop orders, to help you implement this patient approach effectively.

How Buy-Stop Orders Can Help Avoid False Breakouts

What Is a Buy Stop Order?

A buy-stop order is a pending order used by traders. The order is only triggered when the price reaches the level.

Unlike a market order, which executes immediately at the current market price, a buy-stop order waits for the price to hit a predetermined level above the current market price.

The opposite is the same for a sell-stop order. A trader will manually place an order at a predetermined level below the current market price.

This approach allows you to trade with confirmation rather than speculation.

In essence, you’re telling the market to prove its strength before you invest in it.

Why Use Buy Stop Orders?

Buy and sell-stop orders are particularly useful for avoiding false breakouts.

When the price approaches a support or resistance level, it often teases traders into entering prematurely, only to reverse and trap them in a losing position.

Placing a stop order at a predetermined level will validate the direction even further.

Developing a Step-by-Step Strategy to Avoid False Breakouts

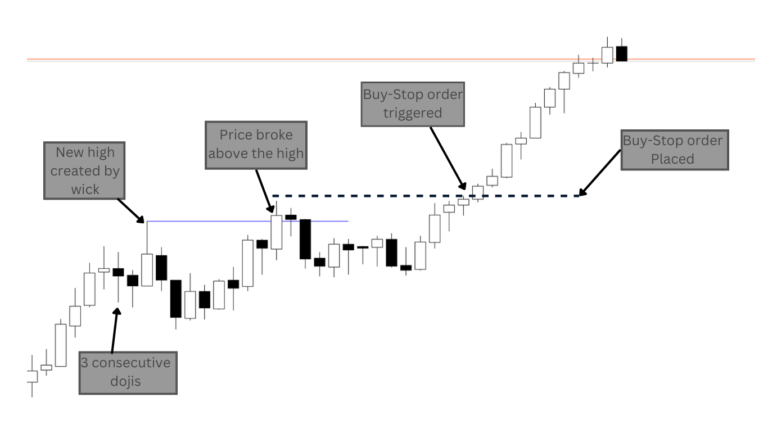

Let me show you how this is done in a real-life scenario. You can see in the image above, starting from the left we have a push-up in price. Price then pauses in the form of 3 consecutive doji candles.

Next, we have a bull bar with the price closing near its middle. This candle creates a new high before we get a push-down. Let’s assume you want to buy if the price breaks above the wick of that high because of the previous buying power presented by price action.

You can see that the price finally broke above the high. Look what would have happened if you had got in at the market price at the close of the breakout candle. If you have your stop loss below the low of the breakout candle then you would have been stopped out 2 candles later.

On the other hand. If you placed a buy-stop order 1 pip above the high of the breakout bar as illustrated. You would have been safe on the sidelines until the price confirmed your analysis by triggering you into the trade.

Patience would have paid off in this case as you can see. Price continued without any drawdown. You could have easily had a small protective stop-loss with the potential of a huge return in comparison.

Psychological Challenges: Overcoming Impulsive Trading

Understanding Impulse Trading

Impulse trading is one of the biggest hurdles for traders, especially when faced with breakout scenarios.

The fear of missing out (FOMO) often drives traders to act prematurely, jumping into trades the moment the price begins to move. Add frustration from previous losses, and you have a recipe for emotionally driven decisions.

When a false breakout occurs, these impulsive trades can quickly turn into regrettable losses.

It’s easy to convince yourself that you’re “catching the move early,” only to realize moments later that the breakout was a fakeout.

Emotional trading clouds judgment, leading to overtrading or entering positions without proper confirmation.

Building Emotional Resilience

To overcome impulsive trading, you need to strengthen your emotional resilience. This means being able to separate your emotions from your trading decisions and sticking to a clear plan.

Here are a few strategies to build resilience:

- Acknowledge Emotional Triggers: Recognize when emotions like fear, greed, or frustration are influencing your decisions. Self-awareness is the first step to overcoming impulsivity.

- Detach from Outcomes: Focus on executing your strategy correctly rather than obsessing over whether a trade wins or loses. Trust that consistency will yield results over time.

- Take Breaks: When emotions run high, step away from your trading desk. Even a short break can help you reset and approach the market with a calmer mindset.

Patience in Practice

Patience isn’t just a mindset—it’s a skill you can cultivate with practice. Here’s how to integrate it into your trading routine:

- Set Specific Entry Rules: For example, only enter a trade if the price closes above a key level or after a breakout bar confirms momentum. By relying on predefined rules, you remove the temptation to act impulsively.

- Use Visual Reminders: Place a sticky note on your monitor with a phrase like “Wait for confirmation” or “The market will still be there tomorrow.” These cues can help anchor you in moments of doubt.

- Reinforce Positive Behavior: When patience leads to a successful trade (like waiting for confirmation with a buy-stop order), take time to reflect on the outcome. This reinforces the value of disciplined decision-making.

In the scenario I described earlier, patience was the key to avoiding the false breakout and entering the trade at the right time.

Remember, the market rewards those who wait for the right opportunities, not just the first ones that come along.

Developing emotional discipline and practicing patience consistently can significantly reduce impulsive trading, helping you stay aligned with your strategy and avoid costly mistakes.

Conclusion

False breakouts are a challenge every Forex trader encounters, but they don’t have to be the cause of consistent losses.

By approaching the market with patience and a clear plan, you can turn these situations into learning opportunities for growth and strategy adaptability.

In this article, you’ve learned:

- What false breakouts are and how they occur due to market noise, news events, or sudden reversals.

- The importance of patience in avoiding impulsive trades, waiting for confirmation, and trusting your strategy.

- Price action patterns that don’t get you into the market but rather to look out for that can help you sit out of the market during a higher probability of a false breakout occurring.

- How buy and sell-stop orders can act as a safeguard against entering trades prematurely, allowing price to validate your analysis before you commit.

- The psychological challenges of trading, including overcoming FOMO and frustration, and how to develop emotional resilience through discipline and self-awareness.

- A step-by-step strategy for identifying and managing false breakouts, as illustrated with a real-life example.

Mastering these skills requires consistent effort, but the rewards are well worth it. Patience and discipline not only protect you from unnecessary losses but also position you to capitalize on high-quality trade setups.

If you’re ready to take your trading to the next level, check out my mentorship program.

Or if you simply need an easy but effective Forex strategy The Precision Pip Pro strategy delivers just that. It’s designed to help traders like you succeed in the Forex market.

Remember, the market is always there—success comes to those who wait for the right moment.

Keep trading smart, stay disciplined, and always prioritize quality over quantity.