The Ultimate Scalping Strategy for the 5-Minute Timeframe

Scalping on the 5-minute timeframe offers traders a fast-paced, rewarding approach to navigating the markets.

Today, I want to share a strategy specifically designed for this timeframe that works across Forex, indices, and precious metals. This system has been carefully tested and refined to provide consistent results while keeping things simple.

Here’s what makes this strategy unique:

Here’s what makes this system stand out:

- It prevents over-trading.

- Requires only 1 to 3 trades daily.

- Easy to understand and implement.

- Filters out barbed wire and choppy markets.

- Increases the chance of well-timed entries.

The Theory Behind the Strategy

This isn’t a groundbreaking method; it’s my interpretation of time-tested systems like the Wyckoff Spring, the ABCD pattern, and other accumulation-driven setups. All these systems share a common trait: they capitalize on market strength supported by accumulation.

By analyzing patterns and refining them through backtesting, I’ve developed a system that aligns with price action and is consistently profitable. As you explore this strategy, you’ll notice other familiar patterns working together to support your trades.

Indicators That Matter

While some traders shy away from indicators, this system uses them as tools to confirm accumulation and momentum shifts. These indicators ensure that every trade is backed by solid price action.

- Bollinger Bands: Period 10, Shift 1, Deviation 0.66.

- MACD: Fast EMA 6, Slow EMA 17, MACD SMA 1.

These indicators don’t predict price but filter valid setups, helping you start a new “campaign” when momentum shifts.

Putting It All Together

Buy Setup

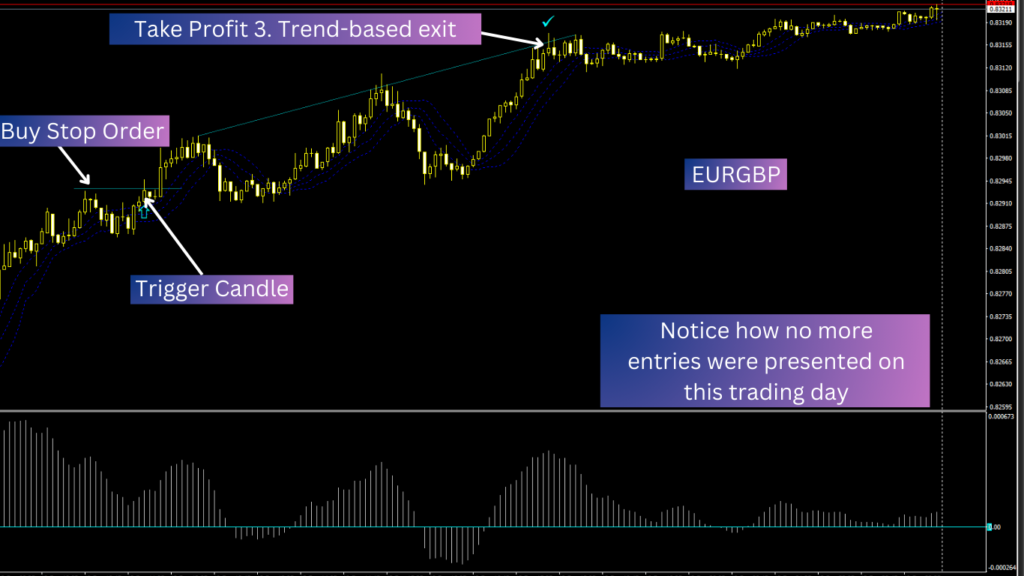

Step 1: Watch for the MACD to cross above the zero line. This indicates the start of a new campaign.

Step 2: Wait for the price to pull back into the Bollinger bands. It’s okay if the price closes below the bands.

Important: If MACD crosses below the zero line, switch to a sell campaign.

Step 3: Draw a resistance line at the highest point before the pullback.

Step 4: Wait for price confirmation. When the price breaks and closes above the resistance level, place a Buy Stop order 1 pip above the high.

Note: If the price wicks above but doesn’t close higher, go back to Step 3 and redraw the high. This ensures the market confirms its strength before entry.

Cancel Buy Stop: If the Buy Stop order isn’t triggered and the MACD crosses back below the zero line, cancel the order.

Sell Setup

The process for a sell setup is the mirror opposite:

Step 1: Watch for the MACD to cross below the zero line. This marks the beginning of a sell campaign.

Step 2: Wait for the price to pull back into the Bollinger bands. Again, it’s fine if it closes above the bands.

Important: If MACD crosses above the zero line, switch to a buy campaign.

Step 3: Draw a support line at the lowest point before the pullback.

Step 4: Wait for price confirmation. When the price breaks and closes below the support level, place a Sell Stop order 1 pip below the low.

Note: If the price wicks below but doesn’t close lower, go back to Step 3 and redraw the low.

Cancel Sell Stop: If the Sell Stop order isn’t triggered and the MACD crosses back above the zero line, cancel the order.

Managing Trades

Your stop-loss and take-profit levels will depend on your preferred style:

- 1:1 Risk-Reward Ratio: Place the stop loss 1 pip below (or above) the breakout signal candle. Target an equal distance for your take profit.

- 2:1 Risk-Reward Ratio: Use the lower (or upper) Bollinger band as the stop loss and target double the risk amount.

- Trend-Based Exits: For advanced traders, exit on the third touch or breakout of a wedge. This approach maximizes gains by riding trends to their fullest potential.

Why This Strategy Works

This scalping system combines the best of technical analysis with practical tools to avoid false signals. By focusing on accumulation and price strength, you align your trades with the market’s true momentum.

It’s simple enough for beginners yet effective enough for seasoned traders. Remember, success comes from consistency and disciplined execution.

Ready to start trading smarter? Test this strategy, refine it to match your style, and see the results for yourself.

Explore More at Elite Forex Partner

For up to date and in-depth trading insights, regarding this strategy visit Elite Forex Partner. Let’s grow together!

Your blog is a treasure trove of valuable insights and thought-provoking commentary. Your dedication to your craft is evident in every word you write. Keep up the fantastic work!